💸 How to Use a Notion financial template to Achieve Your Savings Goals

Managing finances as a student or young professional can be challenging. With tuition fees, living expenses, and the occasional splurge, it’s easy to lose track of your spending. Enter Notion—a versatile tool that, with the right Notion financial templates, can help you take control of your budget and work towards your savings goals.

In this guide, we’ll explore how to effectively use Notion financial templates, specifically tailored for college students and young professionals, to manage your finances and achieve your savings objectives.

🎯 Why Use Notion for Financial Planning?

Notion Financial Template offers a customizable platform that allows you to create and manage databases, calendars, and trackers—all in one place. For students and professionals aged 15-30, this means you can tailor your financial planning to fit your unique lifestyle and goals.

Benefits of Using Notion Financial Templates:

Customization: Tailor templates to match your financial habits and goals.

Integration: Combine financial planning with academic or work schedules.

Accessibility: Access your financial data from any device.

Visualization: Use charts and graphs to visualize your spending and savings.

🛠️ Setting Up Your Notion Financial Template

1. Choose the Right Template

Start by selecting a financial template that suits your needs. HooHoo Planner offers a variety of Notion templates designed for budgeting, expense tracking, and savings goals.

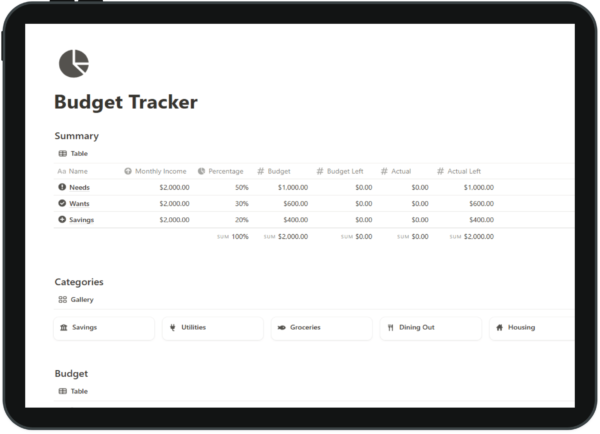

2. Customize Your Categories

Modify the template to include categories relevant to your expenses, such as:

Fixed Expenses: Rent, utilities, subscriptions.

Variable Expenses: Groceries, transportation, entertainment.

Income Sources: Part-time jobs, scholarships, allowances.

3. Set Your Savings Goals

Define clear, achievable savings goals. For example

Short-Term: Save $500 for a new laptop in 3 months.

Long-Term: Save $5,000 for a study abroad program in a year.

Use the template to track your progress towards these goals.

4. Regularly Update Your Data

Consistency is key. Make it a habit to input your expenses and income regularly. This practice will provide you with accurate insights into your financial habits.

📈 Tips to Maximize Your Savings

Automate Savings: Set up automatic transfers to your savings account.

Review Monthly: At the end of each month, review your spending to identify areas where you can cut back.

Use Visual Aids: Leverage Notion’s capabilities to include charts that show your spending patterns.

Stay Motivated: Regularly remind yourself of your savings goals and the reasons behind them.

📚 Additional Resources

For more templates and resources tailored for college students and young professionals, explore the following:

Notion Templates for College Students:

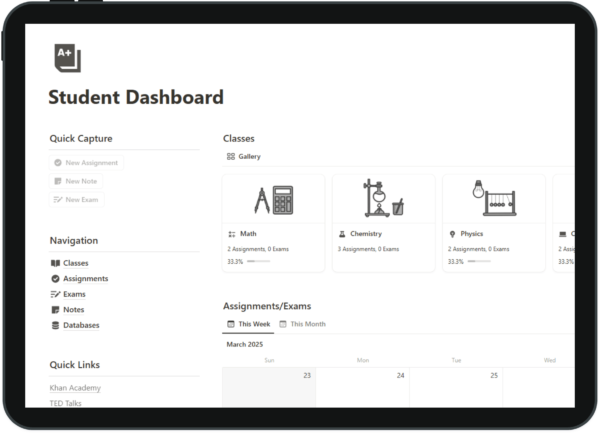

Student Budget Tracker 2025 Template:

🚀 Start Your Financial Journey Today

Taking control of your finances is a significant step towards achieving your personal and professional goals. By utilizing Notion financial templates, you can create a structured, personalized approach to budgeting and saving.

Remember, the journey to financial stability starts with a single step. Choose a template, set your goals, and stay committed. Your future self will thank you.

Reference: www.notion.com